What If Candy Is as Addictive as Some Drugs? This Groundbreaking Test Reignites the Debate

Recent studies reveal that 62% of people feel addicted to sweets, often battling guilt and cravings. Discover the emotional ties to sugar and learn how to break free from this…

Heat Wave Hack: This “Caveman Method” Keeps Your Home Cool Without AC, Experts Say

As temperatures soar, are you ready to keep your home cool? Discover the surprising “caveman method” and other clever hacks that can transform your space into a refreshing retreat this…

Too Many Showers, Not Enough… Experts Reveal the Right Balance After 65

Did you know seniors over 65 might only need one or two showers a week? Discover how simple changes in shower habits can keep skin healthier and more comfortable as…

These Are the 9 Plants You Should Always Grow Next to Basil for a Flavorful, Abundant Harvest

Did you know that basil can enhance the growth of its garden buddies while naturally keeping pests away? Discover how this aromatic herb can transform your garden into a thriving…

Stop Throwing Them Away! 8 Surprising Uses for Tea Bags You Probably Didn’t Know About

Think tea bags are just for brewing? Think again! From skincare miracles to clever cleaning hacks, discover how these everyday items can transform your routine. Don’t miss out on the…

Found in Every Hotel Room, This Innocent-Looking Item Could Be a Hotbed for Fecal Bacteria

Think your hotel room is clean? A shocking 80% of hotel items may harbor fecal bacteria, including the glasses you use. Discover how to stay safe and avoid hidden hygiene…

Germs and Grime: The 9 Surfaces You Should Never Leave Dirty for More Than 24 Hours

Transform your daily routine with simple cleaning habits that keep your home fresh and inviting. Discover how small changes can prevent bigger messes and create a healthier space. Don’t miss…

No Orchard Needed: These 8 Fruit Trees Thrive Almost Anywhere

Unlock the secret to a fruitful garden! Discover the best fruit trees that thrive in your climate, offering delicious rewards and low maintenance. Don’t miss out on transforming your backyard…

This Nutritionist Warns: Why Pairing Steak and Yogurt Might Be a Bad Idea

Eating yogurt after steak? You might be sabotaging your iron absorption! Discover how everyday food pairings can affect your nutrient intake and what simple tweaks can boost your health. Don’t…

Only Children: 8 Personality Traits They Often Carry Into Adulthood

Growing up as an only child shapes unique traits like creativity and self-reliance, but it also comes with high expectations. Curious about how this upbringing influences adulthood? Discover the surprising…

Your Tomato Plants Will Love This Simple Baking Soda Trick — A Guaranteed Recipe for a Tastier Harvest

Discover how a simple pantry staple can transform your tomato garden! Baking soda not only sweetens your harvest but also keeps pests at bay. Curious about the right techniques to…

These 8 Childhood Experiences Often Leave Invisible Scars in Adulthood

Childhood experiences shape our self-worth in profound ways. From criticism to neglect, these early influences can haunt us for years.

Heatwave: The Spanish Water Bottle Trick to Replace Air Conditioning (Without Breaking the Bank)

Beat the heat without breaking the bank! Discover how a simple frozen water bottle can transform your space into a cool oasis. Don’t miss out on this clever trick that…

15 Iconic Dishes Every Middle-Class Mom Cooked in the ’80s

Discover how the ’80s transformed American dining with bold flavors and fun convenience! From Sloppy Joes to monkey bread, this nostalgic journey reveals the tasty trends that still influence our…

If He Says One of These 8 Phrases, He Probably Sees You as His True Soulmate

Words reveal more than love; they unveil deep connections. Discover the powerful phrases that signal true soulmate bonds, going beyond simple expressions and shaping meaningful relationships. Don’t miss out on…

Psychology: 10 Family Members You’re Better Off Keeping at a Distance for Your Own Well-Being

Some family members can drain your energy and self-esteem without you realizing it. Discover how setting boundaries can transform your mental health and help you reclaim your peace at home.…

Kind but Lonely: 7 Common Traits of Lovely People Who Still Don’t Have Close Friends

Ever wonder why some genuinely nice people have just a few close friends? Their unique traits might surprise you. Discover the hidden challenges behind forming deep connections and the beauty…

They Play the Victim to Avoid Blame: 8 Manipulative Behaviors to Watch Out For

Ever noticed someone who always plays the victim? This behavior often hides deeper insecurities and can be tough to navigate. Discover the surprising psychological patterns behind it and how to…

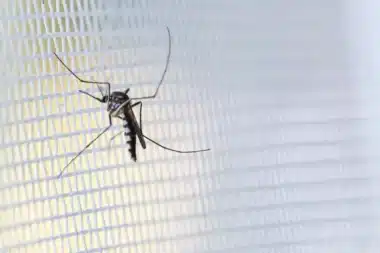

“Since I’ve been using them, none of them have bitten me”: 3 gadgets that will keep mosquitoes away from your home this summer

Tiger mosquitoes are on the rise in France, linked to over 2,000 disease cases this year alone. Don’t let your summer be spoiled—discover how to protect your home and keep…

Are you trapped by your own words? Discover the phrases that hold you back!

Words shape our reality—are you aware of how the phrases you use influence your feelings and mindset? Discover how shifting your language can unlock new possibilities and transform your emotional…

White vinegar is very effective against weeds when these two kitchen products are added

Discover how a simple kitchen staple can revolutionize your gardening game! White vinegar, when mixed with common ingredients, offers a natural way to tackle stubborn weeds without harsh chemicals. Curious…

This supermarket fruit contains the least pesticides, you can buy it with your eyes closed

Did you know avocados rank at the top of the “Clean Fifteen” list for low pesticide levels? Discover how this creamy fruit not only shields you from chemicals but also…

A new country switches to the Euro, coffee will cost 1 euro there

Bulgaria is set to adopt the Euro on January 1st, transforming its economy and tourism landscape. With prices still low, will this change attract even more travelers? Discover how this…

Mastercard must reimburse millions of people, even those with a Visa card

Mastercard’s recent court ruling could mean refunds for 2.5 million people. Imagine getting money back without digging through receipts! Discover if you qualify and what this legal twist means for…

Say Goodbye to Aphids: Eco-Friendly Solutions That Work

Aphids can devastate your garden, but did you know a simple mix of baking soda can keep them away? Discover effective, eco-friendly solutions to protect your plants and maintain a…

The bottom of the toilet will always be white: a single dose of this product is enough to whiten the bowl in 20 minutes

Transform your toilet cleaning routine with a natural powerhouse! Discover how percarbonate of soda can tackle stubborn stains and keep your bathroom fresh, all while being eco-friendly. Don’t let grime…

750 kg Shark Detected Near Atlantic Beaches, Guidelines for Safe Swimming

A massive great white shark named Contender, weighing 1,653 lbs, is cruising near popular Atlantic beaches. With safety measures on high alert, will your summer plans be affected? Discover what…

They talk to their dog like a friend — here’s what it really reveals about their personality

Did you know that chatting with your pet can boost your emotional intelligence? Discover how these quirky conversations can enhance your relationships and spark creativity while revealing fascinating insights about…

How to Naturally Fight Black Spots on Your Roses

Black spots on roses can ruin their beauty and health. Discover how a surprising ingredient might be your secret weapon against this pesky fungus, ensuring your blooms stay vibrant. Don’t…

If he says this without thinking, he’s already crazy about you (even if he won’t admit it yet)

Growing up in an emotionally unstable home can leave scars you didn’t even know you had. Discover how these hidden patterns shape relationships and self-worth, and unlock the path to…

The Best Way to Clean Baking Sheets, According to Experts

Dirty baking sheets can spoil your favorite recipes and even pose health risks. Discover simple, natural cleaning hacks that not only protect your bakeware but also ensure delicious results every…

New York is banning gas-powered lawn equipment—here’s what that means for homeowners

New York’s bold electrification plan aims to transform lawn care while tackling pollution. But can everyone afford the switch? Discover the challenges and benefits shaping this greener future that might…

How Much Water Do Tomato Plants Really Need? Here’s the One Answer You Should Follow

Unlock the secret to thriving tomatoes! Did you know that watering techniques can drastically change your harvest? Discover the surprising factors that influence your tomato plants’ health and learn how…

Prune These 8 Plants in July for the Best Blooms and Growth Next Year

Did you know that July is a game-changer for pruning certain plants? Discover the secret to healthier blooms and bountiful harvests with expert tips that could transform your garden this…

This 5-Ingredient Sheet Pan Gnocchi with Summer Vegetables Is My Favorite Easy Dinner Right Now

Transform your summer dinners with this vibrant sheet pan gnocchi recipe! Packed with fresh veggies and bursting with flavor, it’s the ultimate quick fix for busy nights. Don’t miss out…

I’m a Cleaning Expert—Here’s How I Use White Vinegar to Keep Towels Soft and Smelling Fresh

Transform your laundry routine with a surprising kitchen staple! Discover how white distilled vinegar can revive your towels, making them softer and fresher without harsh chemicals. You won’t want to…

My grandmother’s coleslaw is a masterpiece—here’s the secret ingredient that makes it unforgettable

Uncover the mystery behind grandma’s unforgettable coleslaw! What secret ingredient elevates her recipe from ordinary to extraordinary? Dive into the kitchen magic that turns simple meals into cherished memories and…

This 102-Year-Old Doctor Has Over 100,000 TikTok Followers—Here’s How He Defines A Successful Life

At 102, Dr. Howard Tucker defies aging norms, still practicing medicine and inspiring over 100,000 TikTok followers. Discover his secrets to vitality, social engagement, and a life rich in experiences…

Blueberry washing is key to avoiding pesticides and bacteria – a food scientist shares the best method

Think rinsing blueberries is enough? Think again! Discover the surprising truth about washing fruit that could keep you and your family safe from harmful residues. Don’t let your snack turn…

The Pixie Cut Is the Most Flattering Hairstyle for Women Over 60—Here Are 15 great Examples

Unlock a fresher, more vibrant you with a chic pixie cut! Discover how this youthful style can boost your confidence and showcase your natural beauty. Don’t let age limit your…

I’m an Architect—This $20 Cooling Hack Helps Me Sleep When It’s 100 Degrees Out

Discover how a simple fan and damp towel can transform your sweltering nights into a cool oasis. This budget-friendly trick is a game changer for summer sleep—don’t miss out on…

Tired of Strong Odor? Here’s the Only Natural Deodorant Recipe You’ll Ever Need

Ditch the chemicals and discover how simple ingredients like coconut oil and baking soda can keep you fresh all day. Many are making the switch—don’t miss out on this game-changing…

What Sleeping With Your Dog Does to Your Health, According to Science

Did you know that 41% of dog owners share their beds with their furry friends? Discover how this cozy habit not only deepens your bond but also brings surprising health…

Seniors, This Shower Habit Could Be Damaging Your Skin!

Rethinking daily showers could transform your skin care routine! Discover how adjusting your shower habits might lead to less irritation and a happier complexion for seniors. Don’t miss out on…

Cinnamon is a gardening powerhouse—here are 7 ways to use it in your garden

Unlock the hidden power of cinnamon in your garden! This pantry staple not only repels pests but also speeds up plant healing—curious how? Discover the age-old secrets behind this natural…

I’m a home expert and this is the best way to prevent bad smells from drains while I’m on vacation

Returning home from vacation shouldn’t come with a nasty surprise. Did you know a simple glass and paper trick can keep your drains fresh? Discover how to avoid unwelcome odors…

How Aging Affects Your Sleep: Tips for Restoring Your Nightly Routine

Aging can wreak havoc on your sleep, leading to restless nights and groggy mornings. Discover simple lifestyle tweaks that can transform your rest and enhance your well-being as you age.…